Introducing Solomon

Make Every Dollar Earn

TL;DR

What it is: A Solana‑native dollar system with USDv (spendable stablecoin) and sUSDv (staked USDv that accrues the yield from a delta‑neutral basis trade). For qualified holders, YaaS can stream the basis trade yield directly to USDv without staking.

What’s live today: Everything is live today (and proven in a year-long beta). The web application. The Meteora liquidity pools. The yields and the basis trade powering them. And more.

How it earns: Yield comes from delta neutral basis trade (spot‑long / perp‑short) across BTC/ETH/SOL majors; capture perp funding. T-bill yield is in the works.

Safety & transparency: Segregated custody with insurance coverage + no directional risk with live accounting, third-party audits, and regular attestations you can verify.

What’s next: MetaDAO raise Nov 14–18, 2025, then public protocol launch (USDv, sUSDv, YaaS onboarding).

Why Solomon exists

We’re building a more composable dollar. A dollar that stays at a dollar, doesn’t rebase, and earns yield. Across the defi ecosystem, from swap protocols to perp protocols, users are exposed to stablecoins that pay them no yield. Solomon changes that, giving billions in idle capital the opportunity to become productive.

In plain English: what Solomon does

Captures funding yield from delta neutral basis trade (~16% APY)

Passes it to the right holders: stakers (sUSDv) and eligible USDv holders via YaaS.

Keeps dollars spendable and composable while still earning yield

What’s live today

Engine. Custom, ground‑up orchestration: portfolio/risk (limits; concentration & exchange caps), pricing/oracle layer, position lifecycle (open/roll/close), circuit‑breakers and kill‑switches. Venue‑agnostic to allow for scalability

Security. Independent audits are complete for the core programs and critical infrastructure, with continuous monitoring and alerts.

Program controls. Principle of least privilege: Admin key controlled by a Squads multisig can only set roles and whitelists; asset managers can withdraw only between the protocol and approved custody addresses.

App. Production interface with live assets/liabilities, realized & unrealized P&L, and distribution history (Peak here)

Custody & connectivity. Live with Ceffu custody; exchange connectivity with Binance; additional venues ready to be added as we scale

Oracles & integrations. Pyth price feeds; DEX pools live (e.g., Meteora DLMM); and more integrations queued.

Observability. Real‑time position tracking and venue liveness checks

How it works

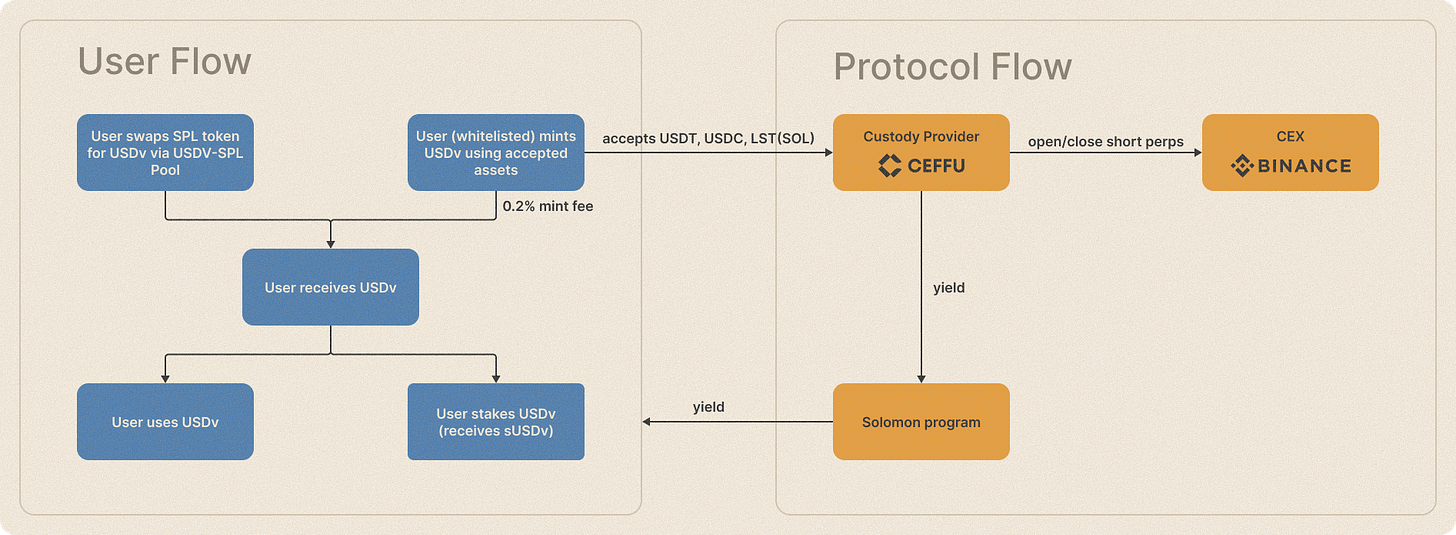

Solomon uses a two‑token design:

USDv — $1 stablecoin held near its peg by two‑way arbitrage. Typical entry/exit is via stablecoin pools on Solana. Approved market makers and compliant parties can mint/burn.

sUSDv — stake USDv to earn the yield generated from the basis trade. Rewards are dripped to the Staking Program multiple times per week to keep distributions smooth and prevent front-running.

Yield engine. Executes basis trade (Hold +1 spot / –1 perp on majors) on CEXs; price moves offset; captures the yield generated from the funding rates. (T-Bill backing is being integrated)

Architecture. App (dashboards & controls) ↔ Onchain vault programs ↔ Custody (CeFFU) ↔ Exchanges (Binance)

What we’ve done so far: year long beta

For the past year, we quietly deployed onchain, stood up core infrastructure, and focused on productionizing risk, limits, custody flows, monitoring, alerting, and integrations. With zero social presence, users still found us via DeFiLlama and onchain analytics, letting us operate with real users and real TVL. YTD 2025, the strategy averaged ~26% APY, with monthly distributions recorded onchain.

The protocol has been battle-tested live through one of the most volatile stretches in crypto, which included the largest liquidation event in crypto history during the Binance dislocations which occurred on 10/10. Even as the temporary depegs led to forced mass short covers, our basis engine held up with zero incidents. That stress-test is what gave us the conviction to take Solomon public.

How we’re different

Stablecoins have moved from no yield (USDC/USDT) → permissionless stake‑to‑earn (e.g., sUSDe). Solomon advances this by giving the yield directly to the dollars that are being used. Either by staking (sUSDv) or via YaaS for qualified USDv holders, without breaking spendability or composability.

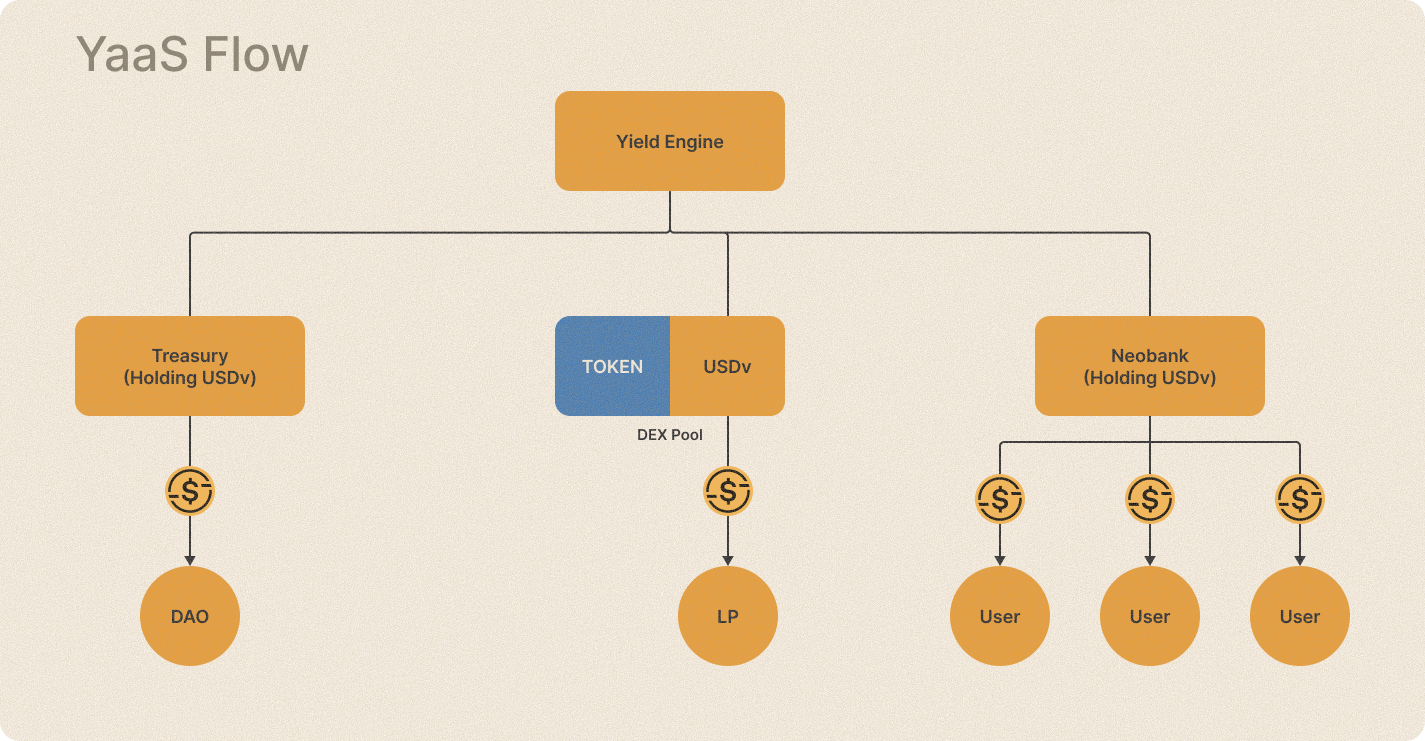

Introducing Yield as a Service (YaaS)

What it is: A programmatic yield stream paid directly to eligible USDv wallets. no staking, no lockups, no wrappers.

Who qualifies (examples): Teams/DAOs/LPs that complete KYC/AML and counterparty onboarding.

Capabilities: Direct 1:1 mint/burn/redeem for USDv, streamed yield directly to USDv holders

LP “Yield Hook”: The USDv leg in a DEX pool gets a programmatic yield stream, so LPs earn pool fees + yield on that leg. No routing or contract changes. (Historically ~15% APY)

NOTE: Anyone can earn permissionlessly via staking their USDv to earn basis trade yield

Who it’s for

DAOs & treasuries: Earn on idle dollars without lockups; opt into YaaS to receive streams directly to treasury wallets.

DEX LPs: Layer base rate on top of trading fees for the USDv side of pools.

Neobanks & fintechs: offer accounts where dollars auto-earn in the background. No staking, no lockups, minimal slippage, and no single-DEX reliance

Transparency & proofs

Liabilities onchain: USDv total supply and distribution visible on Solana.

Assets and positions: Custody statements (Ceffu), exchange position snapshots,

Status & disclosures: Live accounting dashboard, distributions history

What’s next

Friday, Nov 14–18, 2025 — MetaDAO raise. Full participation details, caps, and mechanics are in the separate MetaDAO post.

After the raise — Protocol launch. Exact timing will be announced post‑raise; USDv (spend), sUSDv (save), and the first YaaS cohort will go live.

If you’re a builder, LP, or treasury and want to plug in, reach out. The stablecoin market is about to take its next step.

Solomon

Make every dollar earn

Website | @solomon_labs on X | Discord | Docs