Solomon Lab Notes 03

Last week, Stephen and I spent Breakpoint in back to back conversations with backers, funds, LPs, and ecosystem partners. The consistent takeaway was clear: across the board, people are extremely eager to see YaaS live. Momentum is strong, and we’re now one step closer to shipping it.

Protocol

TVL continues to climb as we lift caps. It’s up a further ~30% since the prior update and has now crossed $3,000,000 (the UI will reflect this shortly once positions are rebalanced). We’re raising caps again to onboard the next wave of users, while keeping custody, venues, and risk controls comfortably ahead of growth.

YaaS Progress and Integrations

YaaS is now being integrated with our first major neobank partner. It’s self custody, so users keep full control of their funds while getting a much better default experience for holding stables.

What YaaS unlocks for their customers:

Earn yield without staking or lockups. No separate staking flow, no wrappers, no unwrapping, and no cooldown mechanics. The dollar keeps normal spend and transfer behavior

Self custody stays intact. Users keep the same primitives (send, swap, spend) while yield is delivered as a routed stream, not a product they must opt into by moving funds.

Programmatic yield routing. We allow the neobank to support per user routing, product level routing, or policy based routing without forcing users into a different asset representation.

In practice, this means stable balances inside the neobank can earn by default while keeping USDv behaving like money should. Importantly, their users won’t need solomon beta whitelisting to access the yield stream. We’ll share more details in a formal announcement soon.

In parallel, we’re continuing to move toward onboarding our first LPs for YaaS. More to come.

Engineering

This week shipped 50+ commits across the codebase, concentrated in three areas:

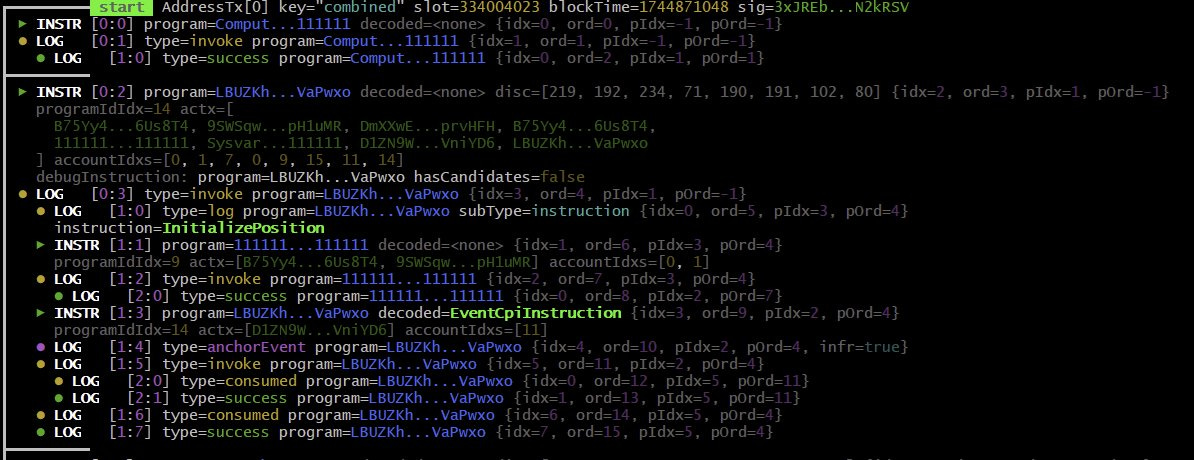

Solana parsing and event stream correctness

Cleaner event log handling, tighter Anchor CPI parsing, and expanded replay coverage for edge cases. This is foundational work: the AMM execution layer depends on consistent inputs and verifiable state transitions.AMM execution layer progress

Continued implementation of the remaining pool mechanics that unlock treasury actions and power YaaS. We also added websocket RPC transport with gap backfilling to stay synchronized when connections drop or data arrives late.Internal tooling and automation

Built a terminal UI framework for high leverage workflows (data introspection, stack traces, transaction log viewing, state transition tracing), plus automated markdown and PDF generation to produce internal reviews and reports with less manual overhead.

UI/UX: Product Clarity, Mobile UX, Brand Refresh

We’re continuing to iterate on UX/UI with three priorities:

Clarity: surface the right info at the right time without overwhelming the screen. YaaS UI will ship in phases as components come online.

Mobile navigation: a ground-up rethink of mobile flow so core actions and wayfinding are obvious, including a reworked Home experience for positions and acquiring USDv.

Polish + brand: microinteractions and a tighter brand system so the app feels good to use daily. We revamped the “Your Portfolio” card, and the broader brand refresh is feeding into a redesigned landing page.

Venues and Yield Stack

We are in the last mile of onboarding our T-bill venue alongside the existing basis trade strategies. This diversifies the USDv yield stack across regimes rather than tying it to a single source. In parallel, we’re actively onboarding additional venues and custody providers. Compliance timelines are largely non-negotiable.

Legal, Governance, and Docs

Internal legal review of the DAO and protocol structure was completed prior to Breakpoint. Ten documents totaling 60+ pages are now with the MetaDAO council for review and comments. Once that review is complete, we’ll move forward with the treasury USDv proposal.

Team

A new developer joined (ex Google, Superteam, multiple Solana hackathon wins) and is already contributing alongside Joshua on execution and YaaS. We are still interviewing for a senior backend hire and others.

What’s Next

As we’re pushing towards opening up to the public, some of the remaining work depends on external parties and compliance timelines, and it’s slower than we’d like. That’s exactly why we’re expanding the team aggressively: we have a clear path, we know what needs to be built, and we want to compress the time between “possible” and “live” by increasing throughput on everything we can directly control.

YaaS is a true 0-to-1 innovation: yield earned without staking, without wrappers, without changing underlying asset behavior. We’re building it as generalized infrastructure with real implementation depth, not as a one off feature. Once it lands, it becomes a new primitive that others build on top of.

Solomon

Make every dollar earn

Website | @solomon_labs on X | Discord | Docs