Solomon Lab Notes 04

If you only look at the surface, the last month might have looked quiet. Underneath, it was the most consequential stretch of building we’ve had so far.

Let’s dive straight into what’s happened over the last few weeks. Near the end, I’ll cover our rollout strategy.

Security and Audits

Audits with Cantina started last week:

The code has been battle tested onchain for over a year, including being live through 10/10. We’ve now brought in Cantina to review it with additional independent security researchers as we head into rollout. The audit is expected to wrap up later this week.

Team

We brought on a senior backend engineer to help us scale YaaS along with hardening the rest of the infrastructure.

His background is a rare mix of high performance market plumbing and crypto-native infrastructure. He started in high-performance exchange connectivity at Goldman Sachs, then went deep into blockchain across SSI, benchmarking and testbed evaluation, and MEV research on FCFS chains like Algorand. He later became a founding engineer at an MPC custody startup, where he helped build the core cross-chain integration framework.

He also completed a master’s thesis at TU Munich analyzing LP profitability and market making strategies in prediction markets, centered on Polymarket’s transition from AMM to CLOB. Take a peek here:

We’ve also brought on additional capacity for marketing execution via experienced operators with backgrounds at Disney, Netflix, DoorDash, and Amazon. They’ve translated that experience into crypto, alongside deep consumer product instincts, and will be integral to the incoming rollout.

Legal, Governance, Compliance, Custody, and Venues

This is the part we’ve spent more time on than we would’ve liked, and we thought we were closer to finished earlier. But it’s also the part that determines whether everything that follows is durable.

We’ve been iterating the DAO operating agreement aggressively. We’re now past dozens of drafts, converging on a ~130 page package built around three primary instruments, several secondary instruments, plus a formal process layer for how governance evolves over time. We’re working with two law firms and the MetaDAO legal team to get this right.

In the previous update, we mentioned venues, custody, compliance, and third party integrations were the long pole in the tent. On this front, there’s been meaningful progress. We’ve onboarded additional execution venues and custody partners, so we now have the redundancy and diversification we need to scale responsibly. There’s still some compliance and legal work to close out, which ties directly back to the governance work above. And there’s one more third party integration we’re pushing to complete that’s taking longer than expected.

Once these pieces are finalized and live, we can put up our first proposal, deploy treasury assets, and begin announcing the partners we’ve been integrating in the background.

Quick notes on why this matters:

Integrations and BD

A lot has moved here, but most of it is still under NDA, so we can’t share details yet.

We announced the Avici integration:

We’re working with Avici to go live with YaaS, and that will land during the next phase I cover near the end of this update.

We’ve also had inbound from other teams exploring YaaS as an infrastructure layer. We’ll share more once it makes sense to do so.

UI/UX and Product

There’s a lot happening across UI/UX right now, from brand down to performance and core flows.

Brand refresh

I want Solomon to look and feel like the company we are, and match the importance of what we’re building. We’re getting close.

We’re out of high-level exploration and in finalization now: colors, typography, visual system, core assets. The direction is locked, this is iteration and polish (roughly ~90% complete). Next up is a new landing page, then we refactor the app design to fully match the updated brand system.

Site performance

We’re cleaning up accumulated frontend bloat that’s been dragging initial load and flows dependent on external calls (RPC, etc.). Biggest win so far is reducing external calls on load from roughly ~20 per page load to ~4, along with stripping unnecessary code and assets loaded at init.

This is mostly invisible work, but the app should feel materially faster as it rolls out.

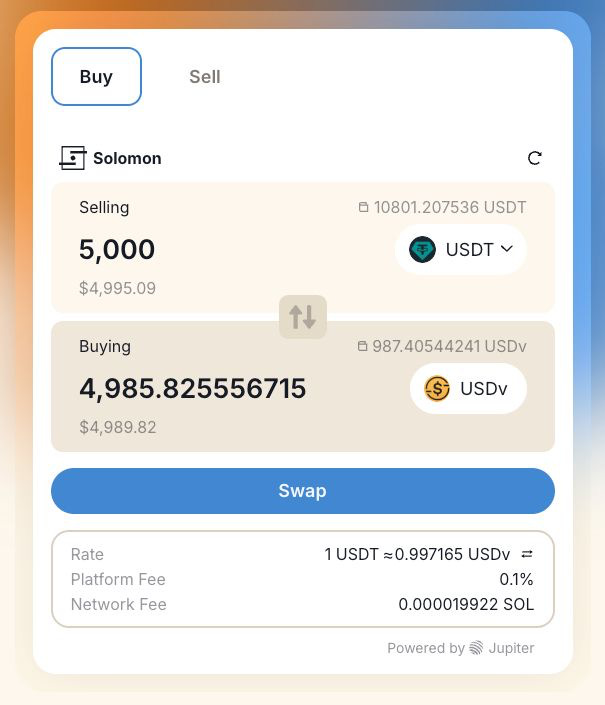

Swap experience

We fixed a swap widget issue that broke embedded buy/sell flows for USDv, which forced users to route via Jupiter directly. The widget is functional again, and we updated styling to better match our design system.

We’re now working on a native swap experience so we can reduce fees and remove third party dependency.

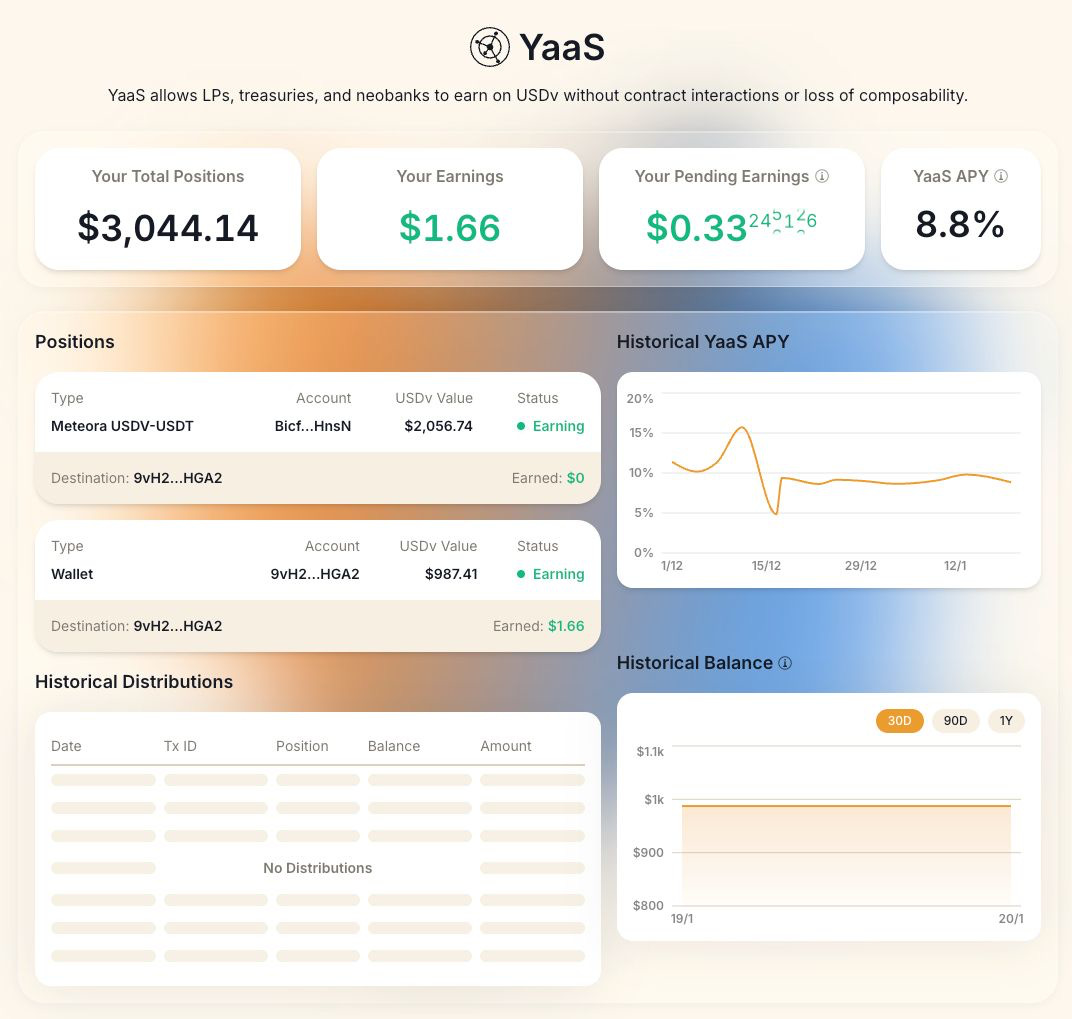

YaaS UI

YaaS UI is complete at an MVP level. The next phase expands position types and improves some of the backend UI/UX. This is something we’ll iterate on as we onboard users and see real usage pattern.

Engineering and Infrastructure

The amount of dev work happening is hard to capture in a single update, but for perspective, last week alone we had 80k+ lines change across the codebase. The production surface area spans 42 repos, and the core repos now total ~660,725 LOC

Some of what we’ve been focused on over the past month:

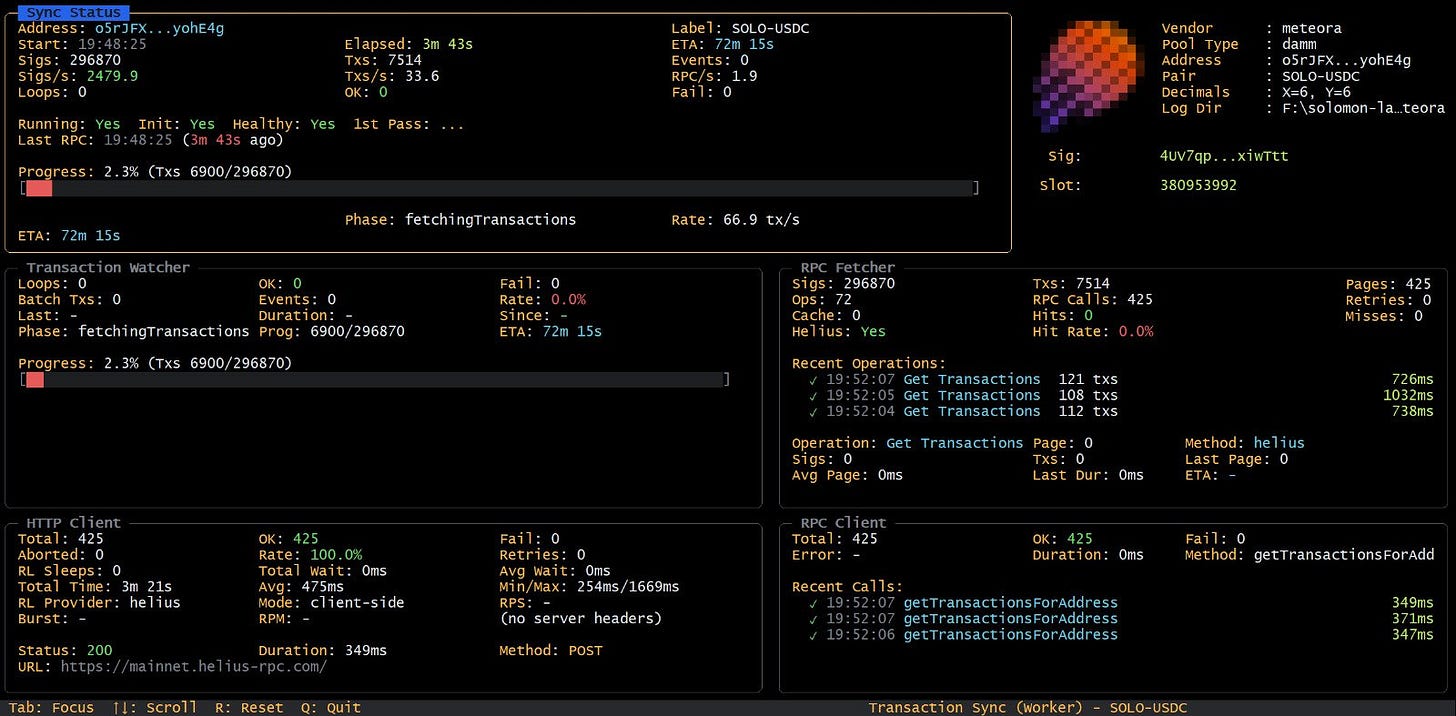

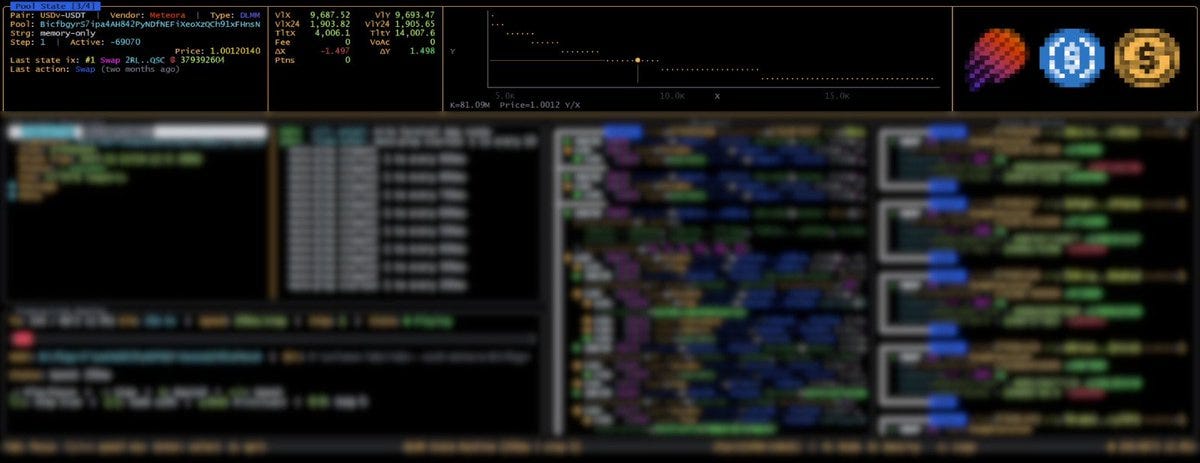

Trading infrastructure (AMM)

Built a visual debugging interface for monitoring pool activity

Added support for multiple AMMs

Improved position-level analytics and tracking

Significant cleanup and reorg to keep things maintainable

Enhanced real-time visualization plus playback tooling

Core libraries

Added foundational data structures (LRU cache, ring buffer, shared buffer)

Built a terminal UI framework and chart primitives for financial visualization

Improved RPC client performance and rate limiting

Improved Solana code generators from program definitions

Developer tools

Expanded automated code generation utilities

Added dependency security scanning

Improved internal documentation tooling

Built deployment automation scripts

Specs

Designed a record schema format and tooling with broad use cases

Established a formal specification framework for protocol components

What’s Next

There are moments in building where everything converges. The idea becomes code. The code becomes a system. The system becomes real. After countless hours spent to bring it into existence, you finally get to see it alive.

If you’re a founder, you live for that moment.

That moment is here with YaaS.

YaaS Rollout

YaaS is the mechanism that lets USDv wedge into the anchor points that matter. Not as a yield feature, but as a routing layer that makes USDv the better default stable leg across LPs, neobanks, treasuries, and eventually margin rails.

Starting next week, we’re kicking off Phase 1 of the rollout. This phase is about showing YaaS in production with select partners, across the core use cases:

Canonical LP positions moving their stable leg to USDv, earning yield on top of swap fees.

Neobank end users holding spendable USDv balances that earn by default

Treasuries adopting YaaS for idle stable balances

████████████████████████████

This will be a first. Historically, stable capital across a lot of these domains has been inert. YaaS changes that.

Everything about this rollout is intentional. We’re working with partners that best showcase the value proposition, while making it clear that YaaS is built to be institutional-grade and trusted. We’ll be closely overseeing and monitoring deployments with the first cohort of users. In parallel, we’ll keep improving the tooling and infra to support the real-world permutations of these lanes cleanly.

Broader Access

In parallel, we’ll overlap this with the second track: broader access to the protocol for retail users. This sequencing gives us time to finish off the remaining legal, custody, and venue work, alongside deployment of our treasury.

The specifics of how we sequence retail access and user growth for USDv will come in a separate post. That post will cover launch partners, and the unique ways USDv and sUSDv will plug into different DeFi verticals as distribution opens up.

Phase 1 starts next week. After that, we’ll share specific dates once the remaining pieces are locked. Until then, expect progress updates. Lab Notes will continue on a monthly cadence.

Metrics Beyond TVL: Stable Productivity

One other area we’re improving is metrics. TVL is a useful headline number, but it rarely captures the full story. It treats a dollar sitting idle the same as a dollar that’s actually being used: providing liquidity, serving as margin, or streaming yield.

It also blurs an important line. A lot of “yield bearing stables” are not really stables. They behave more like share tokens or wrappers that mostly exist to power internal mechanics, not something people use as money across the ecosystem.

As YaaS turns on, we’re going to start publishing metrics that describe how USDv and sUSDv are actually being used, and whether the supply is productive. This is a work in progress, but we want it to capture things like:

Productive supply: how much supply is actively doing work vs idle

Where USDv is anchored: LP lanes, neobanks, treasuries, margin rails

Liquidity quality: depth and spread in canonical pools, not just nominal TVL

Velocity and retention: how USDv moves, how sticky balances are, where it settles

If you have thoughts on metrics that better capture a stablecoin’s productivity, we welcome input. Please reach out.

“We are stubborn on vision. We are flexible on details.” - Jeff Bezos

Building a better dollar is the fixed point. Everything else is iteration.

Solomon

Make every dollar earn

Website | @solomon_labs on X | Discord | Docs