Solomon × MetaDAO

ICO Details

One of crypto’s core ideas is owning the infrastructure you use. The first ICOs made that accessible, then got gamed: back-door allocations, opaque unlocks, and misaligned incentives between builders and holders. Trust broke; capital moved to low-float private rounds at inflated FDVs, and most charts drifted toward zero. In the shuffle, stablecoins, the most used and arguably most important layer, never achieved broad, user-level ownership.

MetaDAO is a reset to first principles: a standardized process, equal terms, and ground-floor access for everyone. It adds built-in guardrails that align builders with the community. Governance is on-chain and binding, which shuts the door on rug pulls, including the slow rug.

MetaDAO matches our ethos. We chose it over a private round because scale comes from distribution, and durable distribution comes from ownership. The people who fund, use, and build the system should share the upside.

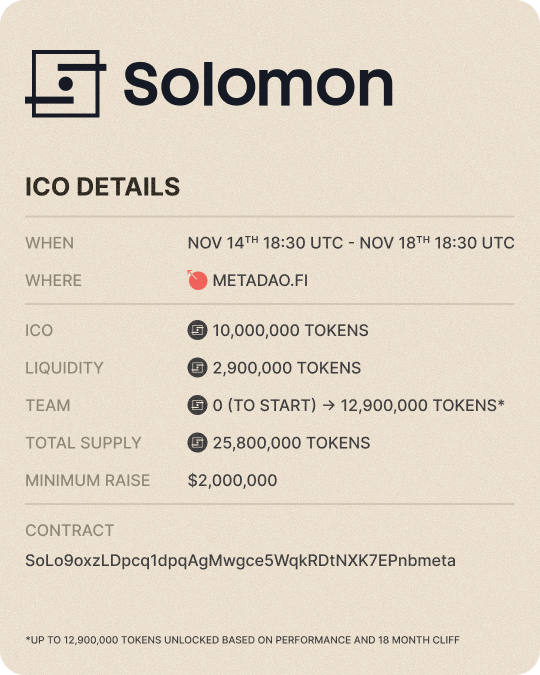

Sale Window

When: Friday, November 14 @ 18:30 UTC through Tuesday, November 18 @ 18:30 UTC (4 days)

Where: MetaDAO

Commit asset: USDC

Ticker: SOLO

TL;DR (Terms at a Glance)

Minimum raise: $2,000,000

Public sale supply: 10,000,000 SOLO distributed pro-rata to participants

Liquidity at launch: Treasury pairs 20% of accepted USDC with 2.9M SOLO into DEX liquidity

Team pre-allocation: 0 at launch; up to 12,900,000 SOLO unlockable via performance

Five tranches unlock at 2× / 4× / 8× / 16× / 32× of the ICO price

Minimum 18-month cliff, with each trigger confirmed by a 3-month TWAP

Monthly team budget: $100k capped, drawn from the treasury and reported publicly

How the Sale Works

Commit USDC any time during the 4-day window on MetaDAO.

At close, we set the final accepted amount (the cap).

If commits ≤ cap, all USDC is accepted.

If commits > cap, everyone is accepted pro-rata and the remainder is refunded.

Pricing is implied by accepted USDC:

Price = accepted USDC ÷ 12,900,000 SOLO

Tokens are distributed pro-rata to participants

If the sale does not reach $2M, all USDC is refunded.

What Happens Right After

Treasury setup: All accepted USDC moves into a market-governed treasury.

Liquidity: Treasury pairs 20% of USDC with 2.9M SOLO into DEX liquidity to support trading and deepen books.

Operations: The team draws its posted monthly budget from the treasury. Larger spends or any new token issuance require governance.

Token Supply at Genesis

10.0M SOLO — distributed to sale participants

2.9M SOLO — seeded into DEX liquidity by the treasury

12.9M SOLO — team performance package, locked until triggers are met

Team Performance Package (Alignment)

Structure: 5 tranches × 2,580,000 SOLO

Price triggers: 2× / 4× / 8× / 16× / 32× of the ICO price

Timing: No unlocks for at least 18 months; each trigger requires a 3-month TWAP before tokens can be claimed

Why This Raise, Why Now|

Solomon has been self-funded to date. In that time we built the product and proved it in the wild:

Mainnet closed beta for the past year with real users and seven figures in TVL.

$28,000 in yield distributed to the beta cohort, annualizing to ~25% APY over the test period, with on-chain, multiple-times-per-week distribution to holders

Yield engine running end to end: pricing, risk limits, lifecycle automation, and safeguards.

Legal and custody stack live with Ceffu for segregated, institutional-grade custody.

Programs audited, on-chain controls enforced, admin secured by Squads multisig, and public dashboards for positions

Stable through market shocks, including the October 10 Binance price dislocation.

Integrations across the Solana DeFi stack ready for launch so USDv and sUSDv are usable on day one.

Most teams raise to build. We are raising to scale.

Planned Use of Funds

We are raising a minimum of $2M. That is enough for a lean flywheel where we bolster up reserves, deepen our USDv liquidity and run a modest liquidity mining program. Our ideal target is $5–8M, but we will only take that amount if the sale is clearly oversubscribed by orders of magnitude. We want real unmet demand after the sale.

What the funds are for (and why it matters)

Day-one treasury deployment

What: Route accepted USDC into the basis engine targeting around 16% APR.

Why: This gets us self-sustaining economics and allows us to earn yield on our treasury day 1.Seed deeper USDv/USDC liquidity

What: Pair ~15% of accepted USDC with USDv into DEX liquidity and maintain strategic top-ups.

Why: necessary to have a sufficient size pool in order to accommodate USDv purchase and routing that will be necessary as other USDv/token pools spin up.Liquidity mining

What: Short term selective incentives to boost yield for USDv and sUSDv. A lot of this is self sustaining as the treasure earns ~16% APY

Why: Accelerates TVL, avoids having to pay mercenaries for short term capital.Venue efficiency: custody and exchange terms

What: Scale balances with custody providers and exchanges to improve fee tiers, withdrawal lanes, and operational priority (custom terms like ADL exceptions at exchanges)

Why: This reduces fees and increases yield for our end users. Improves security and resiliency during market shocksMargin and inventory buffers

What: Top up reserve fund and sufficient buffer reserves for USDv redemptions

Why: Avoids forced deleveraging, preserves the basis, and keeps redemption and arbitrage pathways open under load.Security and transparency

What: Ongoing audits, bug bounties, custody attestations, and public dashboards for positions and treasury.

Why: Trust necessary to scale TVL and users.Operations (fixed and capped)

What: A published $100k per month team budget drawn from the treasury.

Why: Burn stays constant regardless of round size; incremental dollars go to liquidity, yield, and resilience, not headcount.

After the raise, we will take a short window to polish the site and ship the public launch. Then USDv and sUSDv open up broadly, and Yield as a Service (YaaS) onboarding begins for the first cohort.

Own the rails you use. MetaDAO fixes the sale. Solomon fixes the stablecoin.